Chapters 18 and 19. Note: Chapter 19 (questions 11 - 20) will not be on your exam.

____ 1. In a market economy, income depends mostly on

a.

productivity

b.

luck

c.

age

d.

sex

e.

discrimination

____ 2. If official U.S. poverty statistics included in-kind transfer payments,

a.

the poverty rate would be close to zero

b.

the poverty rate would be lower

c.

the government deficit would be lower

d.

the inflation rate would be higher

e.

the top 10 percent of those in the income distribution would be wealthier

____ 3. The official poverty definition in the U.S. is having an income that

a.

provides minimum biological needs

b.

is less than three times the cost of a nutritionally adequate yet frugal diet

c.

places the household in the bottom 20 percent of the income distribution

d.

is less than the average U.S. welfare allowance

e.

is approximately equal to the average household income of Canada

____ 4. Poverty is

a.

a relative concept

b.

an absolute concept

c.

more prevalent in North American countries than in other areas

d.

an insufficient income level to purchase all necessities

e.

the same in all countries

____ 5. Social Security was established

a.

in the 1930s to provide retirement income to those with a work history

b.

in the 1930s to provide jobs for the unemployed

c.

in the 1930s to provide health insurance

d.

in the 1960s to provide retirement income to those with a work history

e.

in the 1960s to provide health insurance

____ 6. The social insurance system generally redistributes income from

a.

rich to poor and from old to young

b.

rich to poor and from young to old

c.

poor to rich and from old to young

d.

poor to rich and from young to old

e.

consumers to producers

____ 7. Food stamps and Medicaid are examples of

a.

money transfers

b.

resource earnings

c.

in-kind transfers

d.

tax expenditures

e.

capital gains

____ 8. The most effective government policy for reducing poverty is to

a.

reduce discrimination in the job market based on gender and race

b.

abandon all government programs and rely on private charity

c.

reduce programs that promote education and training of the poor

d.

dramatically increase Medicare payments to the elderly

e.

promote economic growth and job creation

____ 9. Of the following, which group has the fastest-growing population in the United States?

a.

female heads of households

b.

male heads of households

c.

white heads of households

d.

black heads of households

e.

single people

____ 10. Welfare benefits

a.

may do of all of the following

b.

may discourage poor people from taking jobs

c.

may cause job skills to deteriorate

d.

take the form of cash or in-kind transfers

e.

allow increased consumption by many poor children

____ 11. Which of the following best expresses the benefit from international trade?

a.

With trade, each country can concentrate on producing those goods and services that it produces most efficiently.

b.

With trade, a country can increase its political involvement on a global scale.

c.

Increased U.S. trade would improve high-tech exports but not agricultural exports.

d.

Increased trade would increase U.S. exports and decrease U.S. imports.

e.

Increased trade implies that exports of goods and services will always equal imports of goods and services.

____ 12. Which country is the United States' largest trading partner?

a.

Canada

b.

Japan

c.

Great Britain

d.

Mexico

e.

South Korea

____ 13. U.S. exports

a.

represent approximately 50 percent of GDP

b.

represent approximately 35 percent of GDP

c.

represent approximately 10 percent of GDP

d.

consist primarily of agricultural commmodities

e.

consist primarily of metals and other raw materials

____ 14. World output will be maximized if each country

a.

attempts to be self-sufficient

b.

specializes in producing those goods in which it has a comparative advantage

c.

specializes in producing those goods in which it has an absolute advantage

d.

reduces its consumption possibilities

e.

specializes in producing those goods for which it has the lowest demand

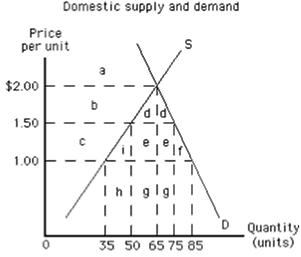

Exhibit 19-3

____ 15. At a world price of $1.00 in Exhibit 19-3,

a.

20 units will be exported

b.

20 units will be imported

c.

50 units will be exported

d.

50 units will be imported

e.

10 units will be exported

____ 16. A tax on imports equal to a percentage of the cost of those imports is known as

a.

a specific tariff

b.

an ad valorem tariff

c.

a tax on luxury goods only

d.

an effective quota

e.

an ad valorem quota

____ 17. An import quota is a

a.

tax on imports

b.

legal limit on the amount of a specific good that can be imported into a particular country

c.

tax on import quantities above the legal limit

d.

way to increase tariff revenues

e.

legal incentive for members of GATT to increase their exports of a particular good

____ 18. The difference between an import quota and a tariff that results in the same domestic price is

a.

none; they are the same

b.

the quantity demanded is higher under the tariff

c.

the world price is higher under the quota

d.

the tariff revenue goes to the domestic government; quota benefits may go to foreigners

e.

none because both quotas and tariffs are illegal

____ 19. The international treaty established to negotiate lower trade restrictions is known as the

a.

World Bank Act

b.

General Agreement on Tariffs and Trade (GATT)

c.

International Association for Free Trade (IAFT)

d.

Countries United for Free Trade (CUFT)

e.

International Development Fund

____ 20. Firms in a high-wage nation such as the U.S. can compete effectively with imports from low-wage nations if

a.

skill levels are identical in the nations

b.

the U.S. reduces tariffs on imports

c.

low-wage nations impose tariffs on U.S. made goods

d.

labor productivity is higher in the low-wage nation

e.

labor productivity is higher in the U.S.

Economics 1B Answers for Quiz on Chapters 18 and 19

1. ANS: A Luck, age, sex, and discrimination may play a role in determining income, but by far the number one determinant is productivity. A person with low productivity will have a low wage.

2. ANS: B. The statistics count only money income, so if in-kind transfers (housing, medical services, legal services, etc) were counted, the poverty statistics would indicate a lower rate.

3. ANS: B Interestingly, the definition of poverty goes back to the early 1930s when a government agency was assigned the task of coming up with a definition of poverty that could be used for government statistics purposes. Since food was considered to be a necessity, they declined that the definition should be related to the cost of food and specifically that the poverty level should be set at three times the cost of a nutritionally adequate diet. No consideration was given to the cost of housing or energy (heating, electric, gas).

4. ANS: A. Poverty is ultimately a relative concept because many of the people in the U.S. that we call poor own a car, a color tv, have access to free education and some public health care, and other items or services that people in many other countries would consider to be luxuries. This is not to say that the poor in the U.S. live well, but most live much better than the poor in Somalia or Darfur.

5. ANS: A. The Social Security system was established in the 1930s and the payments were based on work history and previous income. Those who paid more based on a higher income received more in retirement.

6. ANS: B

7. ANS: C

8. ANS: E. Even though efforts to reduce discrimination based on gender and race are important, unemployment or under employment that results from discrimination tends to be relatively small compared to the unemployment that would result from an economy in recession, so the most effective policy would emphasize a strong and growing economy.

9. ANS: A

10. ANS: A

11. ANS: A

12. ANS: A

13. ANS: C

14. ANS: B. By producing the goods in which the country is most efficient, efficiency and total production are increased.

15. ANS: D. At the price of $1, the domestic demand would be 85, but the domestic supply would only be 35. Importing 50 units would make the quantity supplied at $1 equal to the quantity demanded.. If the world price at been above $2, then this country would have exported the good rather than imported it.

16. ANS: B

17. ANS: B

18. ANS: D. Both the tariff and the quota will result in a higher price for the imported good. The difference is that in the case of the tariff some of that higher price will be tax (tariff) revenues that go to the domestic government. The higher price in the case of the quota (limiting supply causes the price to rise) will result in the higher price being paid to the foreign producer.

19. ANS: B

20. ANS: E. Our ability to compete with countries that have lower wages than in the U.S. is dependent on the productivity of our labor relative to the productivity of labor in the low wage country. For example, suppose that a ditch digger would be paid $1 per hour in Mexico and could dig 10 cubic feet per hour with the shovel that he had. The U.S. worker earns $20 per hour, but uses a backhoe to dig the ditch and is able to dig 250 cubic feet per hour. When we calculate the labor cost per cubic foot, we see that in Mexico the cost per cubic foot of ditch is $0.10 ($1 / 10 cubic feet) and in the U.S. the cost is $0.08 ($20 / 250 cubic feet) per cubic foot. Even though the wage is higher in the U.S., the labor productivity is also higher. Obviously, we will not be importing or exporting ditches, but the same concept of labor cost and labor productivity can be applied in a more complicated example such as the manufacturing of cars or machinery.