Chapter 16

____ 1. Generally, people are more satisfied with private market outcomes than with public voting outcomes because

a.

each consumer in the private market can choose the quantity he or she desires

b.

most people are near the median

c.

the prices are lower

d.

markets are involuntary

e.

there are too many choices to make in the public sector

____ 2. A good that is neither rival nor exclusive is called (Hint: See the definitions of private and public goods)

a.

a private good

b.

a public good

c.

a quasi-private good

d.

an external good

e.

an open access good

____ 3. Public choice theory suggests that political candidates try to get elected by

a.

appealing to conservatives

b.

appealing to liberals

c.

appealing to senior citizens

d.

appealing to the median voter

e.

raising taxes

____ 4. Rationality implies that in order to get what they want, people will spend the most time and effort

a.

making private market decisions

b.

getting politically involved

c.

investigating political candidates' platforms

d.

debating social issues

e.

writing to Congress

____ 5. When the government increases taxes to provide traditional public goods, such as national security, there tends to be

a.

widespread benefits and costs

b.

widespread costs and concentrated benefits

c.

concentrated benefits and costs

d.

widespread benefits and concentrated costs

e.

widespread costs and either widespread or concentrated benefits

____ 6. It is not likely that the costly special-interest farm price supports will be replaced by more efficient direct transfer payments because (Hint: What is a transfer payment?)

a.

farming would cease

b.

such a proposal would attract public attention and threaten the survival of the program

c.

the private gains from price supports exceed the costs to society

d.

a direct transfer program would require too much paperwork

e.

consumers favor the current legislation

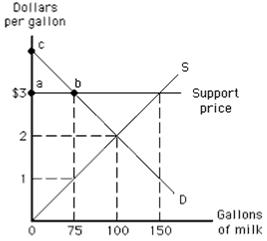

Exhibit 16-1

____ 7. In Exhibit 16-1, triangle abc

a.

represents consumer surplus before the price support

b.

represents producer surplus at the support price

c.

does not represent consumer surplus at the support price because the equilibrium price is not $2.50

d.

does not represent consumer surplus at the support price because the consumer also pays for the storage of cheese, butter, and powdered milk as well as the purchase of excess supply

e.

represents consumer surplus after the price support

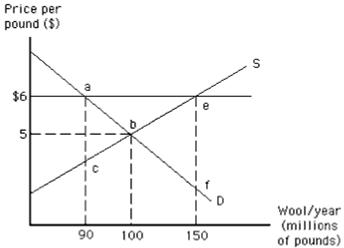

Exhibit 16-2

____ 8. Refer to Exhibit 16-2. How much more will consumers spend on wool because of the $6 price support? (Hint: Unfortunately, this diagram is not to scale. First, determine the price and quantity without the price support, then calculate the total amount spent. Second, determine the price and quantity actually purchased by the public with the price support, then calculate the total amount spent. What is the difference between the two numbers?)

a.

$500 million

b.

$6 million

c.

$40 million

d.

$400 million

e.

$90 million

____ 9. Attempts by special-interest groups to gain favorable treatment from government are called

a.

utility maximizing

b.

profit seeking

c.

rent seeking

d.

profit maximizing

e.

rent minimizing

____ 10. A payment over and above that necessary to call forth a resource is called

a.

profit

b.

rent

c.

taxes

d.

salary

e.

welfare

____ 11. Campaign finance reform is usually proposed

a.

as a way of reducing the power of special-interest groups

b.

as a form of rent seeking

c.

by economists as a way of implementing the median voter model

d.

by political action committees

e.

by the Justice Department

____ 12. A limit on special-interest contributions to national political campaigns (Hint: Special interest groups which would include businesses and unions would be limited on the amount that they could contribute to candidates.)

a.

would give challengers an edge over incumbents

b.

is usually supported by special-interest groups as a way of saving money

c.

would involve widespread costs and concentrated benefits

d.

would reduce the extent of rent seeking

e.

is an example of competing-interest legislation

____ 13. The term underground economy refers to

a.

the coal-mining industry

b.

all ore mining

c.

the subway system

d.

purely illegal activity

e.

market activity not reported to the government

____ 14. A tax on productive activity tends to (Hint: A tax on anything raises its cost or price. What is the consequence of an increase in the price of a good?)

a.

increase formal market activity because it decreases prices

b.

decrease formal market activity because it increases work incentives

c.

decrease formal market activity because it lowers the return on such activity

d.

decrease activity in the underground economy because people are afraid of being connected with tax fraud

e.

increase activity in the underground economy because people are afraid of being connected with tax fraud

____ 15. Filing a fraudulent income tax return that understates income or overstates deductions is known as (Hint: Tax avoidance is legal (just following the rules. Tax evasion is illegal.)

a.

tax evasion

b.

logrolling

c.

tax avoidance

d.

rent seeking

e.

profiteering

____ 16. The fire department receives its revenues from the government budget, not on a per-fire-extinguished basis. As a result, it is difficult for department officials to know if (Hint: Fire protection is a public good

a.

the fire department is even needed

b.

too much or too little fire protection is being supplied

c.

fires should be extinguished

d.

they should raise or lower price

e.

keep the difference between revenues and costs

____ 17. Relative to private firms, we should expect public bureaus to be

a.

smaller

b.

more cost-efficient

c.

less responsive to consumer demand

d.

more concerned with adopting new technologies

e.

more in tune with consumer desires

____ 18. According to William Niskanen, bureaucrats seek to

a.

maximize profits

b.

maximize tax revenues

c.

maximize budgets

d.

minimize variable costs

e.

minimize total costs

____ 19. Which of the following is NOT a typical goal of bureaucrats? (You shouldn't even have to read the text to get this one.)

a.

increasing the size of their bureaus

b.

gaining prestige

c.

increasing the size of their staffs

d.

increasing their bureaus' budgets

e.

achieving greater efficiency

____ 20. In deciding between using a public bureau or a private firm to collect garbage, elected officials may prefer a public bureau because

a.

public bureaus have been shown to be more efficient than private firms in garbage collection

b.

they can convey political favors by giving people jobs in the public bureau

c.

public bureaus will be more responsive to consumers

d.

citizens would have to pay if private firms collected garbage

e.

taxes will be lower if the public bureau is in charge of garbage collection

Economics 1B Answers for Chapter 16

1. ANS: A. With private goods you determine the exact quantity that you wish to purchase. With public voting the decision is usually and all or nothing decision. If politician X votes the way that you want him to about abortion, but not about gun control you are stuck. You can't select a different politician for each view because voting for one politician means that you have to take the politician's view on both.

2. ANS: B. A piece of pie is a private good. As a private good consumption of the good is both rivalrous (it is a rival good) and it is possible to exclude the consumption by another person. If I eat the piece of pie, you cannot also eat it and you can be excluded from consuming my piece of pie. A public good is neither a rival good nor can other consumers be excluded without me incurring additional costs to exclude them. For example, if I wanted to create a radio station that broadcast MY kind of music so that I could listen to it any place in LA this would be a public good. The good is nonrivalrous because no matter how much you listen to my station, the amount that I can listen will not be reduced (your radio will not suck all of the radio waves out of the air and leave nothing for me) and I cannot exclude you from listening without incurring additional costs to scramble the radio signal so that only I could hear the music. Examples of public good include defense.

3. ANS: D. There aren't enough left wing voters to elect a candidate and their aren't enough right wing voters to elect a candidate, so the only way to get elected is to appeal to the middle-of-the-road voter and hope to pick up some of the extreme voters.

4. ANS: A

5. ANS: A

6. ANS: B. The current program raises the income to farmers by limiting the supply of the agricultural goods produced and thus driving up the price paid by consumers. Even though consumers are paying, the amount that we pay is difficult for each of us to see because when we buy a jar of peanut butter we just see the total price. We do not see how much more we are having to pay because of the peanut allotment program that limits the supply of peanuts in the U.S. and thus drives up the price of peanuts and peanut butter. With a direct subsidy program there would be an actual number in the government budget that showed exactly how much income is being transferred to the farmers (from taxpayers) and this number would show the total amount transferred, not just how much is paid by each person. For most taxpayers, seeing that billions of dollars are being given to the farmers would not be politically acceptable. The result is that the real cost is likely to remain hidden as it is in the current program.

7. ANS: D. Answer E would be correct if we didn't have to consider the extra amount that consumers have to pay in taxes to support the subsidy. At the subsidized price consumers will pay $6 for each of the 90 units purchased, but the government (taxpayers) will have to pay to purchase the other 60 (150 - 90) units that will be supplied at the $6 price. The consumers surplus -- the small triangle above the $6 price and below the demand curve -- will be reduced by the extra taxes that have to be collected to buy and store the surplus 60 units.

8. ANS: C. Without the price support, consumers would have purchase 100 units at $5 each for a total expenditure of $500. With the price support consumers will reduce their consumption to 90 units, but at a price of $6 for a total expenditure of $540. The increase in total expenditure would be $40 million.

9. ANS: C

10. ANS: B

11. ANS: A

12. ANS: D. By limiting the spending of special interest groups their "rent seeking" activities would be limited. If a firm that would have spent $100,000 for a lobbyist to try to get special legislation passed that would benefit the firm is limited to $10,000 then the extent of rent seeking activities would be reduced. Even though the benefit to the firm of the legislation would still exist, then firm would not legally be able to expend the same resources in a rent-seeking attempt to get those benefits.

13. ANS: E

14. ANS: C

15. ANS: A

16. ANS: B

17. ANS: C. Decision makers and/or personnel in a public bureau are typically insulated from the threat of loss of employment when they do not respond to the desires of consumers. If the person at the DMV gives you poor service, do they really need to be concerned about losing their job, just because you had to wait an extra hour in line?

18. ANS: C

19. ANS: E. The best answer is E because achieving greater efficiency would imply using fewer resources (people and materials) to do the job. The salary of managers in government is typically based on the number of employees under their supervision; whereas, in a for-profit firm the income is more likely based on the profitability of the first and the particular managers contribution to that profitability, so if the manager can do the same job with fewer people or more efficiently, then there is an incentive to be more efficient. This is not true in a public bureau, which is one of the reason why they tend to have bad reputations for being inefficient. It is not that the people who work for government have a lower ability to produce, but rather that the incentive to be efficient is not as great as in a private company.

20. ANS: B